where's my unemployment tax refund irs

COVID Tax Tip 2021-87 June 17 2021. Making a phone call to the Internal Revenue Service IRS at 1-800-829-1040 You may have to wait a long time to speak with someone.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax.

. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. An immediate way to see if the IRS processed your refund and for how much is by viewing your tax records online. The 10200 exemption applied to individual taxpayers who earned.

The IRS plans to send another tranche by the end of the year. Viewing the details of your IRS account. September 13 2021.

The IRS usually issues tax refunds within three weeks but some taxpayers have been waiting months to receive their payments. The only way to see if the IRS processed your refund online is by viewing your tax transcript. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in. The IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool will not likely provide information on the status of your unemployment tax refund. An outage is determined when the number of reports are higher than the baseline represented by the red line.

Ad See How Long It Could Take Your 2021 Tax Refund. If there are any errors or if you filed a claim for an earned income tax credit or the child tax credit the wait could be lengthyIf there is an issue holding up your return the resolution depends on how quickly and accurately you respond. Using the IRSs Wheres My Refund feature.

For eligible taxpayers this could result in a refund a reduced balance due or no change to tax. By Anuradha Garg. Whether you owe taxes or are awaiting a refund you may check the status of your tax return by.

This is your tax refund unemployment October 2021 update. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. Heres how to check online.

At the moment we havent. Learn How Long It Could Take Your 2021 Tax Refund. See reviews photos directions phone numbers and more for New Jersey Tax Refund locations in Piscataway NJ.

IRS problems in the last 24 hours in Hackensack New Jersey. You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your unemployment tax refund. A quick update on irs unemployment tax refunds today.

The following chart shows the number of reports that we have received about IRS over the past 24 hours from users in Hackensack and near by areas. 22 2022 Published 742 am. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break.

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Irs Has Sent 6 Billion In Stimulus Payments Just In June Here S How To Track Your Money

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

2022 Irs Tax Refund Breaking News Refunds Extended Delays Cp2000 Notice Tax Topic 152 Irs Youtube

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Where S My Irs Refund Paper Returns Taking Months To Process

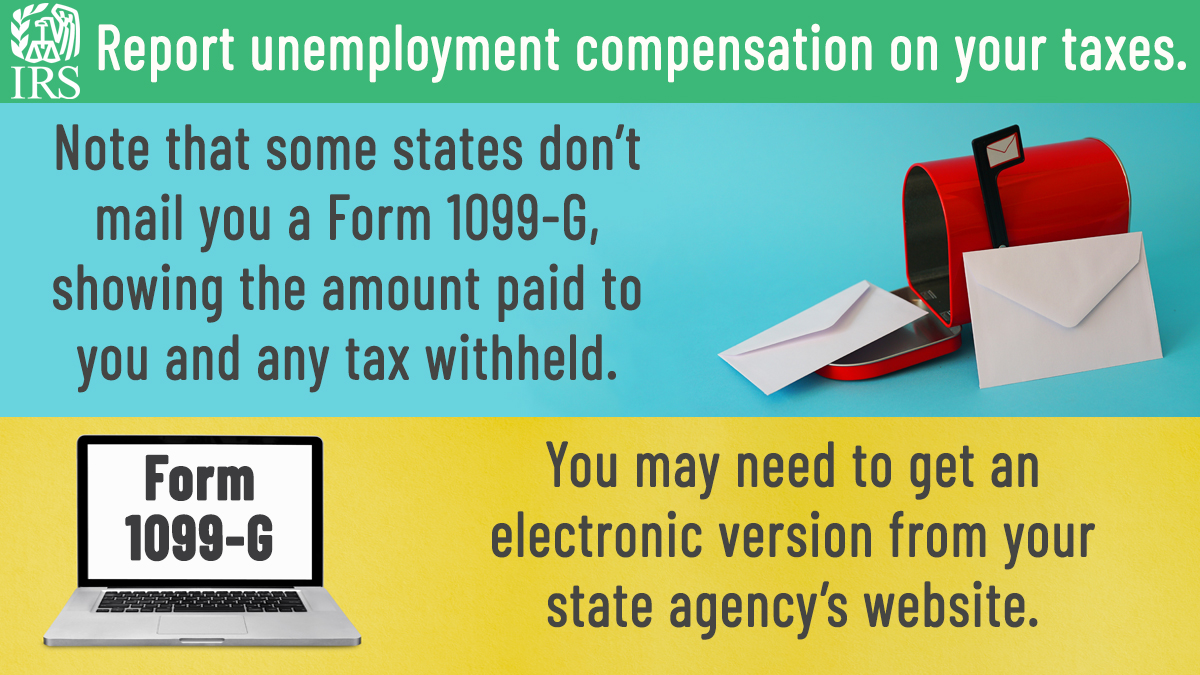

Irsnews On Twitter If You Received Unemployment Compensation During The Year You Must Include It In Gross Income On Your Irs Tax Return See Details At Https T Co Lhsbya2bvu Https T Co Vfio1irxik Twitter

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Announces It Will Automatically Correct Tax Returns For Unemployment Tax Breaks

Irs To Send Another 4 Million Tax Refunds To People Who Overpaid On Unemployment Cbs News

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

How To Check The Status Of Your Tax Return Get Transcripts Tfx User Guide

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Where Is My Money Smokey Where Is My Money Tax Refund Unemployment

Using Your Irs Tax Transcript To Get Updates On Your Refund Direct Deposit Date Youtube

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has